Calculating tips by hours worked is one of the smartest ways to understand your real income—especially if you work in industries like restaurants, delivery services, hospitality, salons, or gig-based jobs. Many workers focus only on total tips, but dividing tips by hours worked provides a clearer picture of earning efficiency and fairness.

Just as businesses use work-in-progress reporting to track income and costs over time, hourly tip calculation helps workers monitor performance, compare shifts, and plan finances more accurately.

This guide will walk you through everything you need to know, from basic formulas to advanced methods, common mistakes, and real-world examples.

Why Calculating Tips by Hours Worked Is Important

Many tipped workers ask: “Am I earning enough for the time I put in?” Calculating tips per hour answers this question directly.

Key Benefits of Hourly Tip Calculation

- Helps you understand your true hourly income

- Makes it easier to compare different shifts

- Identifies high-earning vs low-earning hours

- Supports fair tip pooling and distribution

- Improves budgeting and financial planning

Without this calculation, it’s easy to overestimate or underestimate how profitable your work really is.

Who Should Calculate Tips by Hours Worked?

This method is useful for anyone earning tips, including:

- Restaurant servers and bartenders

- Food delivery drivers

- Ride-share drivers

- Hotel staff

- Salon professionals

- Freelancers receiving gratuities

- Gig economy workers

Whether you work part-time or full-time, calculating tips per hour gives you control over your earnings data.

What Does “Tips per Hour” Mean?

Tips per hour means the average amount of tips you earn for each hour worked during a specific period.

Simple Definition

Tips per hour = Total tips ÷ Total hours worked

This figure does not replace your base wage—it complements it by showing how much extra income tips add per hour.

Step-by-Step Guide: How to Calculate Tips by Hours Worked

Step 1: Track Your Hours Worked Accurately

Record all working hours, including:

- Active working time

- Mandatory prep or closing time

- On-call time (if paid or tip-eligible)

Use:

- Timesheets

- Work apps

- Manual logs

- Employer time tracking systems

Step 2: Add Up All Tips Earned

Include every source of tips, such as:

- Cash tips

- Card tips

- App-based tips

- Shared tip pools

- Online gratuities

Always calculate using gross tips before personal expenses.

Step 3: Apply the Tip-per-Hour Formula

Use this simple formula:

Tips per Hour = Total Tips ÷ Hours Worked

Example

- Total tips earned: $240

- Total hours worked: 40

Calculation:

$240 ÷ 40 = $6 per hour

This means you earned $6 in tips per hour, on average.

Weekly vs Monthly Tip Calculations

Weekly Calculations

Best for:

- Tracking performance

- Adjusting schedules

- Spotting trends early

Monthly Calculations

Best for:

- Budgeting

- Tax planning

- Long-term income analysis

Tip: Use both for maximum clarity.

How to Calculate Tips with Tip Pooling

In many workplaces, tips are pooled and shared.

Tip Pool Calculation Method

- Add all pooled tips

- Divide based on:

- Hours worked

- Role percentage

- Points system

Example

- Total pool: $600

- Total hours worked by team: 120

$600 ÷ 120 = $5 per hour

Each worker earns $5 per hour in tips multiplied by their hours worked.

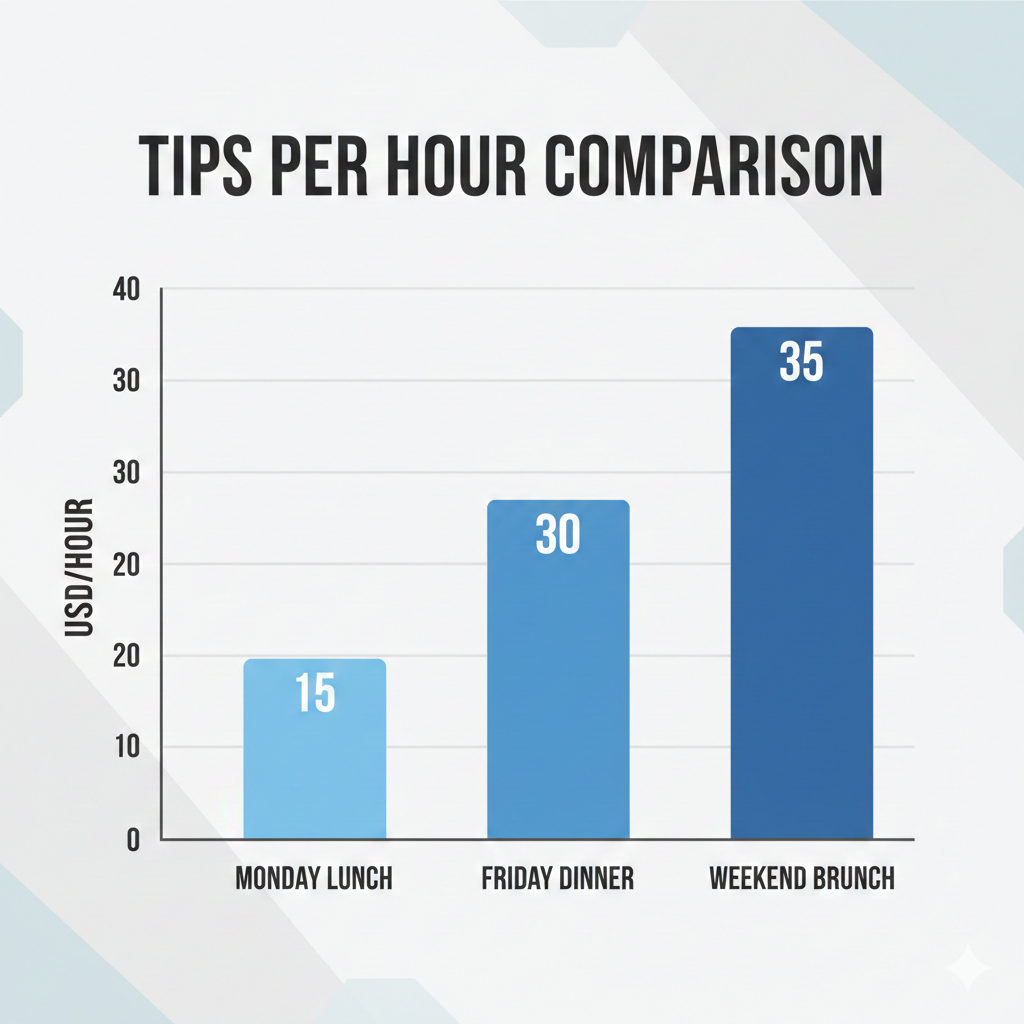

How to Calculate Tips with Different Shift Lengths

Longer shifts don’t always mean better earnings.

Compare Shifts Example

| Shift | Hours | Tips | Tips per Hour |

|---|---|---|---|

| Morning | 6 | $60 | $10 |

| Evening | 8 | $72 | $9 |

Even though the evening shift earned more total tips, the morning shift paid better per hour.

Calculating Tips for Delivery and Ride-Share Drivers

For drivers, tips vary by:

- Time of day

- Distance

- Location

- Demand

Driver Tip Calculation Example

- Tips earned: $90

- Driving hours: 6

$90 ÷ 6 = $15 per hour

This method helps identify the most profitable driving hours.

Including Base Pay with Tips (Optional)

To calculate total hourly earnings, combine tips and base pay:

Total Hourly Earnings = Base Pay per Hour + Tips per Hour

Example

- Base pay: $12/hour

- Tips: $6/hour

$12 + $6 = $18/hour total

Common Mistakes to Avoid

❌ Ignoring Some Tip Sources

Always include cash and digital tips.

❌ Miscounting Hours

Missing even 30 minutes can distort results.

❌ Comparing Different Time Periods

Compare week-to-week or month-to-month—not random days.

❌ Forgetting Tip Pool Rules

Always follow workplace agreements.

Why Employers and Managers Use Similar Calculations

Businesses use progress-based reporting to track income over time. Similarly, hourly tip calculation:

- Measures efficiency

- Tracks performance trends

- Ensures fairness

- Improves transparency

This makes it valuable for both workers and managers.

How Often Should You Calculate Tips?

- Daily: High-volume workers

- Weekly: Most employees

- Monthly: Budgeting and tax prep

Consistency matters more than frequency.

Tools You Can Use to Calculate Tips

- Online tip calculators

- Excel or Google Sheets

- Mobile finance apps

- Custom calculator on your website

Tax Considerations for Tip Income

In many countries, tips are taxable income.

- Keep records

- Report accurately

- Save a portion for taxes

Hourly calculations make tax reporting much easier.

Knowing how to calculate tips by hours worked puts you in control of your income. It helps you work smarter—not just longer—and gives clarity similar to how businesses track progress and profitability.

Whether you’re an employee, freelancer, or gig worker, this simple calculation can lead to better decisions, fair pay, and financial confidence.

Tips Per Hour Calculator

read more